America’s Robotics Crisis Summarized

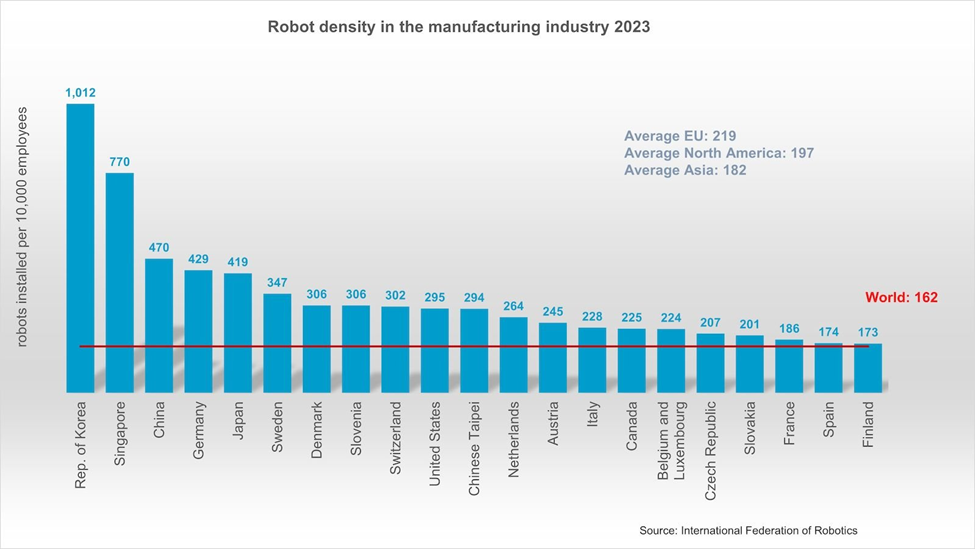

- The US continues to lag significantly behind Asian countries in robot density. South Korea leads with 1,012 robots per 10,000 workers while the US lags far behind

- Market stagnation from 2023 – 2025 has been driven by the 2024 election cycle and ongoing economic/foreign policy uncertainty

- Federal grant programs exist but remain severely underutilized, such as the DOE’s Industrial Assessment Center (IAC) Implementation Grants

- Policy solutions must include better marketing of existing grant programs, multi-year tax incentives for automation adoption. This funding must come from state/local governments to attract robotics manufacturers, and workforce development initiatives

- The window is closing – without aggressive action, the US risks permanent competitive disadvantage as Asian markets continue accelerating automation investments

I’ve been closely following America’s robotics crisis in the United States for nearly two years now. Loosely following it for even longer. But, back in 2023, when I first started digging into the data a bit more deeply, I thought we’d hit a temporary rough patch. I began writing something about it and shelved it. I was intrigued, but the interwebs were saturated with opinions about Industry 4.0, robotics, and automation. It was pretty tough to have an opinion counter to that of those who thought they knew the truth. So I waited on it a bit. I did not like what I was both hearing and seeing being pushed by anyone with an opinion.

Well, after a few years, I guess a few of those people have changed their platform all together. Many, however, stay the course. But, it’s not a bad time to start offering up a different view. Especially since there has been some time to digest the reality and form an extrapolated view of the future. Let’s get to it then.

The Data Doesn’t Lie – And It’s Not Pretty

As of late, the numbers are showing a 30% global decline in industrial robot sales. Even optimists – including the Association for Advancing Automation (A3) – were convinced we’d see a rebound. It’s now 2026 and likely 2025 data will show that hasn’t happened. If anything, the situation has gotten worse. The reasons why should concern everyone invested in American manufacturing competitiveness. This is why I am in the business of providing solutions and not just crying wolf on the interwebs.

The Charts Behind America’s Robotics Crisis!

Let me show you what two years of tracking America’s robotics crisis has revealed. According to the International Federation of Robotics, the US ranked tenth globally in 2023. This was represented by a robot density of just 295 units per 10,000 manufacturing employees. Compare that to South Korea’s staggering 1,012 robots per 10,000 workers, Singapore’s 770, or even China’s 470. China, by the way, only entered the top ten in 2019 and has since surpassed both Germany and Japan. When you look at robot adoption relative to wage levels, the picture gets even more stark. The US sits at just 70% of expected robot adoption given our manufacturing wages, ranking 13th globally on this metric. Meanwhile, China is adopting robots at 12.5 times the expected rate, and South Korea at 8.5 times.

Robot density per 10,000 employees by country, showing the US trailing behind leading Asian manufacturers like Korea, Singapore, and Japan

What makes this especially frustrating is that we’ve seen minimal improvement. And this is despite all the talk about reshoring and revitalizing American manufacturing. Of course, the data from 2025 is not yet complete. From January through September 2024, North American companies ordered 23,034 robots. Valued at $1.4 billion this represents a 1.9% decline in units and 2.2% drop in revenue compared to the same period in 2023. For the full year 2024, orders barely budged, with just 0.5% growth in units and 0.1% in revenue. This isn’t the manufacturing renaissance we were promised.

What’s Actually Driving the Stagnation Behind America’s Robotics Crisis

When I wrote about America’s robotics crisis back in 2024, the story was about strategic waiting – companies holding off on major capital investments due to high interest rates, uncertainty about AI integration with robotics, and inventory corrections from the pandemic buying spree. Those factors are still in play, but something more insidious has taken hold: political and economic uncertainty that has absolutely paralyzed decision – making.

The 2024 election cycle created a holding pattern where manufacturers adopted a “wait and see” approach. Then came 2025, and instead of clarity, we got tariff uncertainty, trade policy whiplash, and economic signals that change weekly. The Economic Policy Uncertainty Index – which tracks exactly what it sounds like – spiked 72 points between January and February 2025 alone. Research shows that a 90 – point increase in this index correlates with a 1.2% decline in industrial production, and we’ve likely exceeded that threshold with continued uncertainty through spring 2025.

Here’s what this means in practical terms: budget holders at manufacturing companies can’t build long – term strategic plans when they don’t know if tariffs will last three months or three years or ten. Capital investment decisions get delayed. Automation projects get shelved and forgotten in favor of more straightforward – widely understood capital choices. And while American manufacturers sit on the sidelines, their competitors in Asia continue investing aggressively in the very technologies that will define the next generation of manufacturing competitiveness.

The Tools Exist – But Nobody Knows About Them

What drives me crazy about America’s robotics crisis is that we actually have programs in place that could help address the adoption gap. They’re just widely underutilized and poorly marketed. Let me highlight three that manufacturers should know about but probably don’t. Tip: Live Solutions is a partner in these programs – and they’re phenomenally beneficial.

Industrial Assessment Center (IAC) Implementation Grants

This program funded through the Bipartisan Infrastructure Law with $550 million allocated to expand the program. Small and medium-sized manufacturers (SMMs) can receive grants of up to $300,000 per assessment recommendation at a 50% cost share to implement energy efficiency, productivity improvements, and emissions reductions. These aren’t loans – they’re grants. Yet according to my contacts within the Department of Energy (DOE) ecosystem, this funding pool remains severely underutilized. This is due to manufacturer education. Most companies simply don’t know it exists. In an exciting turn of events (and seemingly an effort to spend down this funding pool), the Department of Energy is piloting a new avenue. Now the funding includes the adoption of Smart Manufacturing technologies alongside the IAC program. The DOE is hopeful this will help promote the adoption of robotics and advanced manufacturing technologies. This $300,000 grant is available on a per project basis for approved projects after a screening and vetting process implemented by the DOE.

State Manufacturing Leadership Program (SMLP)

California has two – comingled pathways to help SMMs address the Smart Manufacturing gap. The SMLP received $22 million in funding across 12 states (including California) to help SMMs. Primarily, they are pushing SMMs to adopt smart manufacturing technologies, high – performance computing, and data – driven tools. Here’s the catch that most people miss: to access the $300,000 per project IAC funds effectively, manufacturers need to work with a CESMII – certified Smart Manufacturing Accelerated Roadmap consultant. These certified professionals help companies assess their current state across six critical areas: strategy, culture, processes, systems, workforce, and supply chain – and develop a phased implementation plan. The roadmap process typically costs $12,000 – $15,000 for an SMM, which then unlocks eligibility for substantially larger grant funding. It’s a no-brainer ROI especially if the cost can be covered under a state-funded grant program such as the SMLP. Yet, adoption remains limited because the program isn’t widely known outside insider circles. And from what we have seen at Live Solutions – it’s often viewed by SMMs as a tough sell to stakeholders. We get it: when a consultant is going in and offering a “plan” without a concrete outcome or a guarantee of savings, it sounds far-fetched. The cynicism posed by manufacturers is what is going to perpetually peg the US as laggards in the global economy of scale. The ball is in our court, yet we turn and throw it out of bounds rather than give it a dribble or pass down court. Excuse the bad analogy. But even yet in 2025, Manufacturers would rather spend money on tangible solutions – equipment based solutions without a plan – because it makes more sense to them. I will leave these thoughts and opinions for another blog – but I have strong opinions about this tragically flawed approach.

What We Actually Need to Do

Well, one silver lining to help slow America’s robotics crisis is that recent tax legislation has created heavily manufacturer-friendly incentives we’ve seen in years. This includes 100% bonus depreciation through 2029, immediate R&D expensing, and Section 179 expensing for equipment. These provisions allow companies to fully expense robotics and automation investments in the year they’re placed in service. Obviously, this can have a dramatic impact to cash flow optimization and ROI calculations.

I’m not interested in pointing fingers or playing political games here. The reality is that both Democratic and Republican administrations have failed to make America’s robotics crisis a genuine national priority. We need a comprehensive, bipartisan approach that addresses multiple dimensions of the problem simultaneously.

Awareness

In this author’s humble opinion, we need to massively improve awareness and accessibility of existing grant programs. Why not promote programs that pave the way for low-to-no-cost solutions? As a participant in the consortium that is responsible for providing manufacturers in California access to these programs, Live Solutions has experienced these benefits firsthand and can say for certain that these are underutilized pathways that offer tremendous upside for SMMs. The IAC Implementation Grants, SMLP funding, and various DOE manufacturing programs should be household names in the manufacturing community. They’re not. The federal government needs to partner with industry associations, Manufacturing Extension Partnerships (MEPs which are now slowly being defunded by NIST due to severe budget cuts), and state economic development organizations to conduct aggressive outreach campaigns that meet SMMs where they actually are – not where bureaucrats think they should be.

Tax Incentives

Tax incentives need to be predictable and multi-year. The recent restoration of 100% bonus depreciation through 2029 is a step in the right direction. But we need to go further with targeted credits specifically for robotics and automation adoption. One option is to partner with robotic OEMs to offer incentives like we have with EVs in recent years. Other countries have implemented proactive tax policies that incentivize capital investment in manufacturing technology. The US tax code, by comparison, has historically been less generous, effectively penalizing the very investments we should be encouraging.

Supply Chain Improvement

Another key facet is a pathway to aggressively pursue onshoring of robotics manufacturing itself. The fact that America’s robotics crisis is fueled by a reliance on Chinese suppliers is absurd. Even those robots claimed to be “Made in America” – depend on China for core components. This poses a strategic vulnerability we can’t ignore. The US Government should prioritize federal matching funds, both at the state and local levels. This could attract robotics startups and established manufacturers to build facilities in the US. This isn’t protectionism – it’s basic industrial strategy that every other major economy practices.

Enhancing Workforce Development – Workforce 4.0

We have been beating the drum on Labor 4.0 in 2025 and as such, workforce development must be central to any robotics strategy. I’ve spoken about this at great length at conferences and events. According to industry surveys, lack of expertise and insufficient time to implement new automation products are the largest barriers to robotics adoption. This puts labor skill gaps as a top concern, furthering America’s robotics crisis. We need coordinated efforts between community colleges, universities, industry associations, and the local MEP networks. The training of a generation of workers who can program, maintain, and optimize robotic systems is imperative. We are already seeing a huge shift in the Gen Z approach to education – leaning more toward trades than college. This message is being promoted by the IAC program, a prolific training ground for industrial energy efficiency workers. We should aim to expand that model to include robotics and automation specialists – and beyond.

There is a need for change the in the cultural landscape surrounding automation. Survey after survey shows that American workers and managers are more skeptical of robotics than their counterparts in Asia and Europe, often viewing automation as a threat rather than a tool for competitive advantage. It is seen that global robot adoption rates are positively correlated with the degree to which residents believe technology should be emphasized in the future. The US can’t automate itself into competitiveness if there is ambivalence about whether automation is desirable. I find it hard to accept how US media and so-called “thought leaders” continue to perpetuate the “Great Replacement” theory, while there are several nations that have proven there is an attainable, harmonized path forward.

The Window Is Closing

Look, I get it. This isn’t a sexy topic. America’s robotics crisis doesn’t generate the same headlines as AI chatbot villainy or electric vehicle self-driving. Especially when you have Nvidia and Tesla dominating headlines. But the competitive implications are absolutely fundamental to American manufacturing’s future. As I have presented, China has been investing massively in automation technology. This means it is quadrupling its robot density from 97 to 392 units per 10,000 workers between 2017 and 2022. They’re not slowing down. South Korea, Singapore, Japan, and Germany aren’t slowing down. Meanwhile, we have entered year three of a plateau driven by election cycles, policy uncertainty, and a collective failure to make this a national priority or even a prevailing narrative.

Every quarter that passes with anemic robotic adoption is a quarter where American manufacturers fall further behind global competitors in productivity, cost competitiveness, and technological capability. Reshoring only works if we can produce goods cost-effectively despite higher labor rates – and that requires automation at a scale that can boost domestic productivity. The programs, funding, and technological capabilities exist to make this happen. I’m sure I haven’t even comprehensively covered what else is available, but what is missing is urgency, coordination, and political leadership.

We’re building the future of American manufacturing right now, whether we realize it or not. The question is whether we’re building it on a foundation strong enough to compete globally, or whether we’re content to watch other countries define the next generation of industrial capability while we focus on tired narratives and domestic theatrics. Two years of watching America’s robotics crisis unfold has convinced me that we’re running out of time to get it right and if I know anything about business, we don’t have the time to sit around and wait.